Discover the conference programme of BioFIT 2024

Share your knowledge at BioFIT 2024

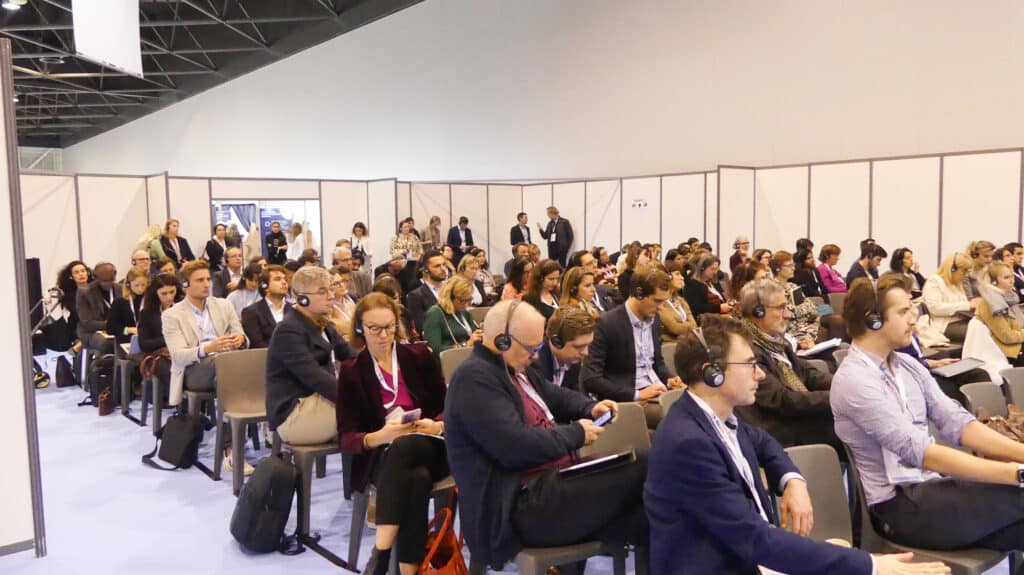

Steered by a distinguished Committee, the BioFIT conference programme brings together bright minds to discuss the latest trends in Life Sciences, to debate innovative topics, to encourage learning and generate conversations that matter.

More than 60 international experts will address current industry issues such as: the right funding sources for early-stage innovation, best practices in academia-industry R&D collaborations, winning ways to nurture early-stage assets and animal health highlights.

Find out more about the BioFIT 2024 conference topics below

Spotlight session

Tuesday, December 3rd, 2024 | 11.15 am – 12.30 pm

Pharma M&As are back, what does it mean for early-stage dealmaking?

While deal volumes have slowed in recent years, in line with overall M&A activity, deals in the life sciences sector appeared to be picking up slightly at the end of 2023. In 2024, lower valuations are expected to provide pharmaceutical companies with additional transaction and acquisition opportunities at a later stage to strengthen portfolios in the face of impending patent expiry, and at an earlier stage as part of a highly selective strategy.

Panellists will look into this seeming resurgence of M&A and its implications for early-stage deals, discussing funding availability, business development prospects and deal pattern observations.

TRACK 1: Best practices in academia-industry R&D collaborations

9.45 – 10.45 am

Biotech start-ups: Which resources do you need to manage your partnership with pharma?

–

3.00 – 3.45 pm

Information is the key: What should you have ready to present your academic asset to potential industry partners?

2.00 – 3.00 pm

Long-term university-industry research programmes or alliances:

Which concrete outcomes and new developments to spark innovation?

TRACK 2: Nurturing and licensing early-stage assets

Early-stage assets evolve in an ecosystem where TTOs, scientists and entrepreneurs are closely connected. Understanding the mechanisms and difficulties of nurturing and licensing assets is key to properly influence the valuation of assets at an early stage. How can we fully understand the proposition behind the value? How can we transform science into business more frequently and efficiently?

2.00 – 2.45 pm

Going beyond the conventional: Exploring innovative deal structures

–

4.15 – 5.00 pm

TTO to TTO collaborations: Examples and success stories of spinning off

academic assets from different institutions into a single company

9.45 – 10.45 am

Diving into the venture builder model:

Unpacking the value proposition in nurturing biotech assets

TRACK 3: From pre-seed to Series A: Accessing early-stage investment

This track aims to understand the mechanisms enforcing investors’ presence in early stages of development. Are we witnessing surges of investment in specific therapeutic areas? Who are the new players involved in investing on the biotech sector and what are their pre-requisites? Are there increasing interactions and partnerships between pharma and VCs at these initial stages?

5.15 – 6.00 pm

Focus on pre-seed financing stage: What works, what doesn’t, and risks involved

11.15 am – 12.30 pm

Biotech investors’ forecast: Where will early-stage investment go in 2025?

3.15 – 4.15 pm

Asset-based vs. technology platform-based start-ups:

Analysing investors’ preferences and mechanisms in funding

TRACK 4: Animal health highlights

This track features the latest innovation challenges in animal health R&D and intends to provide a clear understanding of the bridges that can be built between human and animal health. International experts from veterinary research and industry will discuss the latest initiatives to improve and accelerate the development of new diagnostics, vaccines and pharmaceuticals for animal diseases and beyond.

Topic to be announced soon!

Project - CEO Matchmaking

Wednesday, December 4th | 2.00 – 3.00 pm

The path to becoming a successful CEO: Tips to wanabee founders

The Project – CEO matchmaking activity aims to connect representatives of emerging start-ups, technology transfer offices, incubators and investing networks with CEOs and aspiring CEOs. It includes a dedicated visibility for projects looking for CEOs on the partnering platform and a dedicated conference around recruitment or team-building issues.